Loan Protection

Protect your loans with our Loan Protection services. Your peace of mind is our top priority.

Debt Protection

Designed with you in mind

More than ever, we all worry about things that might happen tomorrow. Debt Protection provides an important sense of financial security – knowing your loan will not become a burden to you in times of hardship.

Under the Debt Protection program, your loan balance may be canceled or your monthly loan payments canceled without penalty or added interest if you are faced with Death, Disability, or Involuntary Unemployment.

You may cancel Debt Protection at any time. If you do so within the first 30 days, we will refund any feed already paid.

Want to learn more?

Talk to a representative today by calling (800) 727-9961 to learn the details about our Debt Protection program.

Availability and plan options

| Available coverage | Cost | ||||||

| Death | Disability | Involuntary Unemployment |

Rates per $1,000 of monthly loan balance Single / Joint |

||||

|---|---|---|---|---|---|---|---|

| Plan option 1 | x | x | x | $2.92 / $5.27 | |||

| Plan option 2 | x | x | $1.99 / $3.49 | ||||

| Plan option 3 | x | $0.92 / $1.47 | |||||

Definitions of coverage

If you meet eligibility requirements and conditions, Debt Protection will provide the following benefits:

Death: helps your family get back on their feet financially with cancellation of loan.

– All Plans: cancels the remaining loan balance as of date of death (up to $75,000)

Disability: cancels your loan payments for a period of time as you regain your health.

– Plans 1 & 2: Cancels up to 12 payments per occurrence (aggregate maximum of $15,000, up to $1,000 per month)

Involuntary Employment: Helps ensure your loan payment will be taken care of as you search for new employment.

– Plan 1: Cancels up to 3 payments per occurrence (aggregate maximum $15,000, up to $1,000 per month)

GAP Advantage

Guaranteed Asset Protection Advantage (GAP Advantage) protects you against financial loss in the event that your vehicle is damaged beyond repair (totaled) or stolen and never recovered.

Eliminates or reduces “out-of-pocket” expenses for the remaining loan balance after loss settlement

You’re able to purchase replacement vehicle sooner because there is little to no carry-over balance

May cover a deficiency balance up to $50,000

Available at a reduced amount compared to other GAP Advantage providers

Fully refundable within first 60 days if no GAP Advantage benefits have been paid

Eligible Collateral & Rates

| Collateral Type |

Max MSRP/NADA Coverage |

Missed Payment Coverage |

Max Limit of Liability |

Max Eligible Loan Term |

Max Eligible Loan Balance |

GAP ADV Cost per Waiver |

|---|---|---|---|---|---|---|

| Autos Light Trucks |

125% | Two (2) Missed Payments (per year) |

$50,000 | 84 Months | $100,000 | $599 |

| Motorcycles ATV’s Snowmobiles Golf Carts Jet Skis |

125% | Two (2) Missed Payments (per year) |

$50,000 | 84 Months | $50,000 | $599 |

| Travel Trailers Watercrafts Motorhomes |

125% | Two (2) Missed Payments (per year) |

$50,000 | 180 Months | $0-$24,999 $25,000-$49,999 $50,000-$74,999 $75,000-$125,000 |

$684 $998 $1,270 $2,000 |

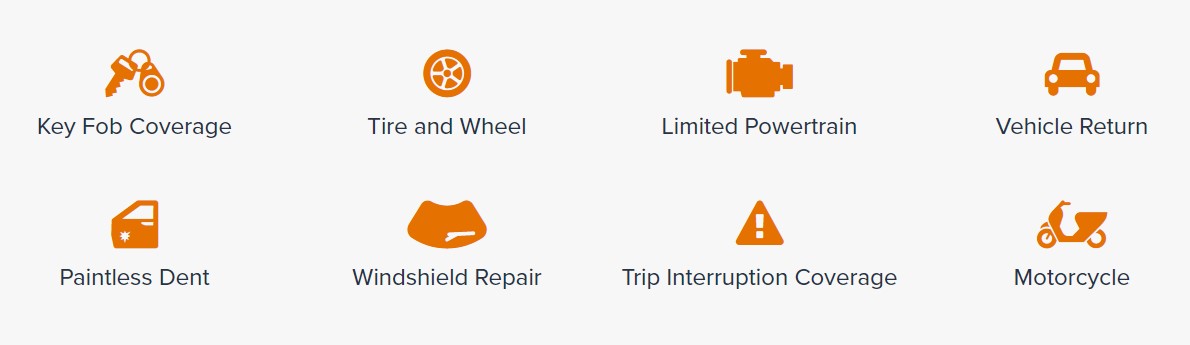

Major Mechanical Protection

Major Mechanical Protection (MMP) makes it affordable for you to keep and enjoy your vehicles longer. You pay for the warranty once, and in most cases, will not have to pay for anything more than a small standard deductible should a breakdown occur.